How To Make Money Fast For Beginners

There are many ways to make money fast for beginners. One way is to start a blog and offer paid subscriptions. Another way is to start an online store and sell products or services. Finally, you can start a freelance business and offer your services to clients. All of these methods can be used to make money fast for beginners.

Ways To Make Extra Money On The Side

There are many ways to make extra money on the side. You can start a blog and sell advertising, write an e-book and sell it online, or start a small business. You can also do odd jobs for people in your community, such as yard work or snow shoveling. You can also sell items you make or find at garage sales. Finally, you can participate in online surveys or sign up for paid focus groups. All of these activities can help you make extra money on the side.

Money Making Tips For Beginners

There are a number of ways to make money as a beginner. One option is to start a blog and generate income through advertising and affiliate marketing. Another option is to start a YouTube channel and generate income through advertising and sponsorships. Finally, you could start a small business and sell products or services online. If you’re looking to make money as a beginner, it’s important to find an avenue that suits your skills and interests. Once you’ve found a way to make money that you’re comfortable with, it’s important to be consistent and put in the work required to succeed. With so many options available, there’s no excuse not to start generating some extra income today.

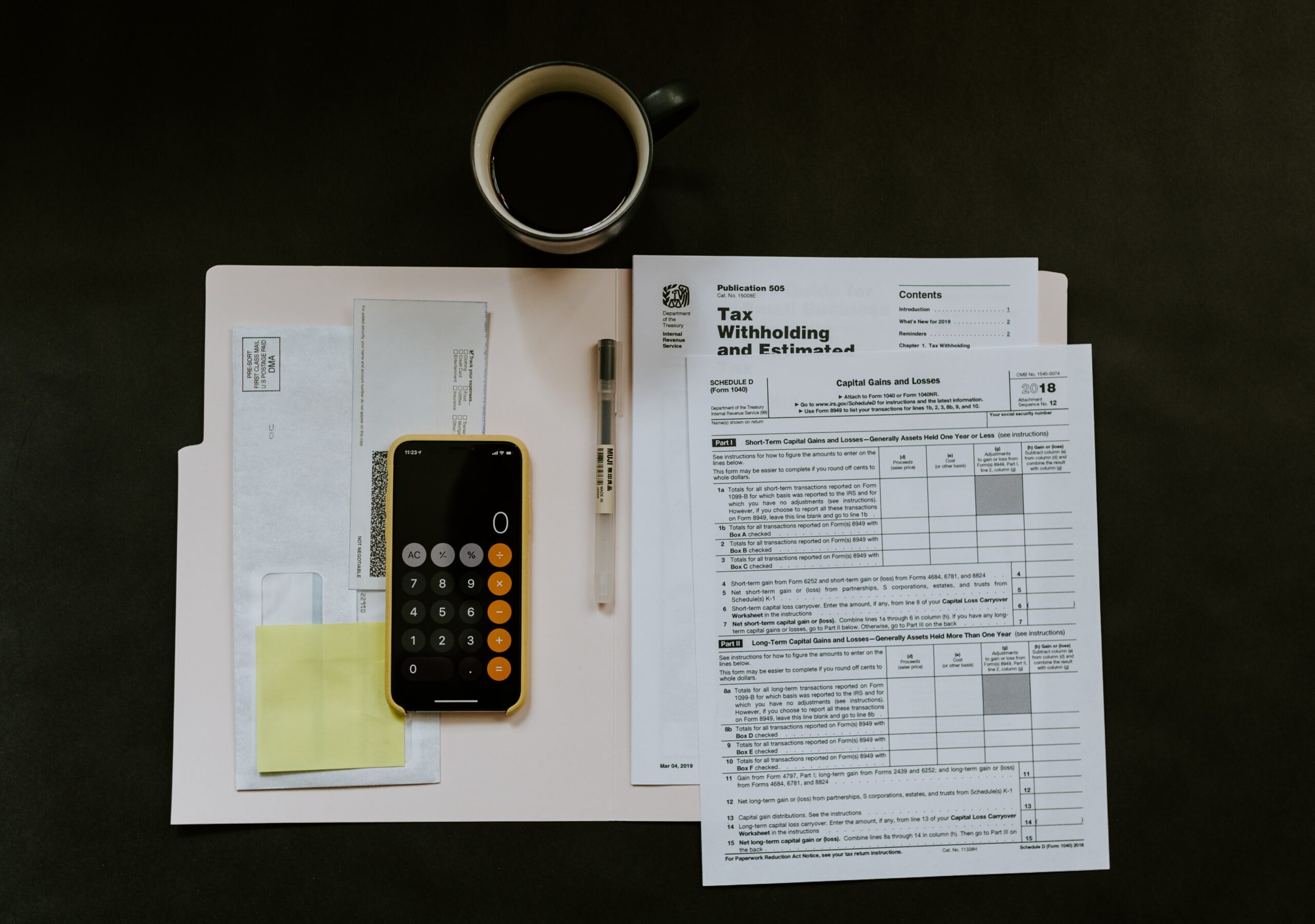

Financial Tips For Beginners

There are a lot of things to learn when it comes to personal finance, and it can be overwhelming for beginners. However, there are some basic tips that can help you get started on the right track. One of the most important things to do is to create a budget and stick to it. You need to track your income and expenses so that you know where your money is going. This will help you to make informed decisions about your spending and saving. It is also important to have an emergency fund to cover unexpected expenses. This will help you to avoid going into debt if something unexpected comes up. Another key tip is to invest in yourself. This means taking the time to learn about personal finance and investing. There are a lot of resources available, so take advantage of them. Lastly, don’t be afraid to ask for help when you need it. There are many professionals who can help you with your finances. Don’t be afraid to reach out to them if you need assistance.

7 side hustle jobs to do one the side

There are a lot of easy ways to make money for beginners. You just have to be willing to put in the effort and have some patience. Here are seven easy ways to make money for beginners:

1. start a blog: You can easily start a blog and make money from ads, affiliate marketing, or selling your own products.

2. take online surveys: There are many companies that will pay you to take online surveys.

3. start a YouTube channel: You can make money from ads or selling products on your YouTube channel.

4. do some freelance work: You can find freelance work on websites like Fiverr or Upwork.

5. sell items on eBay: You can make money by selling items on eBay.

6. participate in focus groups: You can get paid to participate in focus groups.

7. start a pet-sitting business: You can start a pet-sitting business and make money from pet owners.

Passive Income Ideas For Beginners

There are many ways to create passive income, but it can be difficult to know where to start, especially if you’re a beginner. However, there are a few passive income ideas that are well suited for beginners. One way to create passive income is to invest in dividend-paying stocks. This is a relatively low-risk way to create passive income, as you’re not investing in individual stocks but rather in companies with a history of paying dividends. A

nother way to create passive income is to invest in real estate. This can be done either through purchasing property outright or by investing in a real estate investment trust (REIT). Both of these options can provide you with regular income, although investing in property does come with a higher level of risk. Finally, another way to create passive income is to create a blog or website and sell advertising space. This is a more hands-on approach than investing in stocks or real estate, but can be very profitable if done correctly. All of these are great passive income ideas for beginners. While they all require some level of initial investment, they can all provide you with regular, passive income. So if you’re looking to create some additional income without having to work more hours, these are all great options to consider.

Easy Ways To Save Money For Beginners

When it comes to saving money, there are a lot of different methods and strategies that people can use. It can be difficult to know where to start, especially if you are on a tight budget. However, there are a few easy ways to save money for beginners that can help you get started on the right foot. One of the easiest ways to save money is to create a budget. This will help you track your income and expenses so that you can see where your money is going each month. Once you have a good idea of your spending patterns, you can start to cut back on unnecessary expenses and put more money towards savings.

Another easy way to save money is to make sure you are taking advantage of all the discounts and deals that are available to you. For example, many stores offer loyalty cards that give you access to exclusive deals and coupons. There are also a lot of online resources that can help you find discounts on groceries, travel, and other purchases. Finally, one of the best ways to save money is to simply start paying yourself first. This means setting aside a certain amount of money from each paycheck to put into savings before you spend anything else. This can be a challenge at first, but if you can stick to it, you will be surprised at how quickly your savings will grow.

Money Management Tips For Beginners

Money management is something that everyone has to think about at some point in their lives. For some people, it is something that they have to think about on a daily basis. For others, it is something that they only have to think about when they are making major purchases or when they are getting their finances in order. Regardless of how often you have to think about money management, it is important to have some basic tips in mind so that you can make the most of your money. One of the most important money management tips for beginners is to start budgeting. Budgeting may seem like a tedious task, but it is essential for keeping your finances in order. When you budget, you are essentially creating a plan for your money. You are deciding how much money you will need for each month and then allocating that money to different categories. This can help you to avoid overspending in one area and helps to ensure that you have enough money for your essentials. Another important money management tip is to save, save, save. It is never too early to start saving for your future.

Even if you are just starting out in your career, you should be setting aside money each month to put into savings. This money can be used for retirement, a rainy day fund, or even a down payment on a house. The earlier you start saving, the more money you will have in the long run. Another important money management tip is to invest. When you invest, you are essentially putting your money into something that has the potential to grow over time. This can be a great way to grow your wealth over time. There are many different ways to invest, so you will need to do some research to find the best option for you. Finally, one of the most important money management tips for beginners is to stay disciplined. When you are working on your finances, it is easy to get sidetracked. There will be times when you want to spend money on something that you really do not need. However, if you can stay disciplined, you will be able to stay on track and make the most of your money.

How To Invest For Beginners

InvestoRunner has a guide about stocks for beginners in Swedish if you would like to get more info about stock trading.

When it comes to investing, there are a lot of options and strategies to choose from. And it can be tough to know where to start. But don’t worry—we’re here to help. Here are a few tips for how to invest for beginners:

1. Decide what you want to achieve. Before you start investing, it’s important to have a clear goal in mind. Are you looking to save for retirement? Build up an emergency fund? Or maybe you’re hoping to grow your wealth over time. Once you’ve decided what you want to achieve, you can start to look at different investment options that can help you get there.

2. Consider your risk tolerance. When it comes to investing, there’s always some element of risk involved. And that’s OK! But it’s important to understand your own risk tolerance—that is, how much risk you’re comfortable taking on. If you’re more risk-averse, you may want to consider investments that are less volatile, such as bonds or cash. On the other hand, if you’re willing to take on more risk, you may want to consider stocks or other growth-oriented investments.

3. Get started with a small amount. Investing can seem like a big commitment, but you don’t have to start out with a lot of money. In fact, you can begin investing with just a small amount of money. There are a number of investment platforms and apps that make it easy to start small and invest regularly. So if you’re not sure where to start, consider opening up an account with one of these providers.

4. Be patient. Investing can be a long-term game. In other words, you shouldn’t expect to see immediate results. The key is to be patient and stay disciplined with your investing strategy. Over time, you should see your investment grow—and reach your financial goals.